22 Jul, 2024

401(k) Contributions: Strategies for Maximizing Retirement Savings

Every 24 hours, you move one day closer to your retirement date, and your commitment to contributing to your 401(k) should also be peaking. Your...

22 Jul, 2024

Every 24 hours, you move one day closer to your retirement date, and your commitment to contributing to your 401(k) should also be peaking. Your...

24 Jun, 2024

As Benjamin Franklin once said, “Failing to plan is planning to fail.” This adage is particularly true in financial planning, where even small missteps or...

7 Jun, 2024

Today’s blog post will examine an often-overlooked tax strategy for philanthropic purposes: Qualified Charitable Distributions (QCDs). At Brown|Miller Wealth Management, we understand that no one...

29 May, 2024

Did you know that May 29th marks National 529 Day? It’s a little-known “celebration” day, but it’s an important time to explore the benefits of...

22 May, 2024

Health Savings Accounts (HSAs) are powerful tools for helping you manage your healthcare expenses. As a high-income earner, you are likely looking for ways to...

20 May, 2024

Donor-Advised Funds (DAFs) are becoming increasingly popular for families that want to impact their communities and legacies while realizing significant tax benefits for themselves. These...

24 Apr, 2024

The great wealth transfer is a massive financial shift, where an unprecedented amount of money is being passed down from generation to generation, mainly from...

25 Mar, 2024

With the “great wealth transfer” already underway, an estimated $68 to $80 trillion will be passed to future generations. Whether you’re anticipating an inheritance or...

4 Mar, 2024

Over the next twenty-thirty years, 78 million baby boomers will transfer $84 trillion of wealth to their families and the charities they care about. This...

29 Jan, 2024

Over the next two decades, 78 million baby boomers will transfer a staggering $84 trillion. Interestingly, 85% of this wealth transfer, or $72 trillion, goes...

18 Dec, 2023

Just like a compass helps guide you in the right direction, having a comprehensive plan can help guide you through various financial life stages. At...

20 Nov, 2023

It’s easy to fixate on what types of investments you have in your portfolio. But what many people don’t focus on can be equally important...

23 Oct, 2023

What does financial independence mean to you? It’s a question we ask successful executives, professionals, and business owners who are seeking retirement planning services. Success...

21 Jun, 2023

Success, whether in your personal or professional life, often results in an accumulation of wealth that necessitates a more sophisticated approach to financial planning. In...

24 Apr, 2023

As a non-profit, endowment, or foundation organization looking for the best ways to invest your assets, it is crucial to create an investment policy...

31 Mar, 2023

As a non-profit organization or foundation, it is essential that you have access to experienced and knowledgeable investment management. Having the right investment management support ...

28 Mar, 2023

Having an endowment which reflects your organization’s values is more important than ever. But does the wealth advisor you’ve chosen match up to those same...

9 Mar, 2023

As a trustee of a nonprofit, endowment, or foundation, you have the important responsibility to ensure your organization’s assets are being managed with care. Your...

3 Mar, 2023

Non-profit organizations focus on creating a positive difference in their community, an effort that requires financial support for it to be sustainable. By investing resources...

17 Feb, 2023

Choosing the right type of investment or financial advisor can be a difficult task. When researching financial planning services, you want to find someone to...

17 Jan, 2023

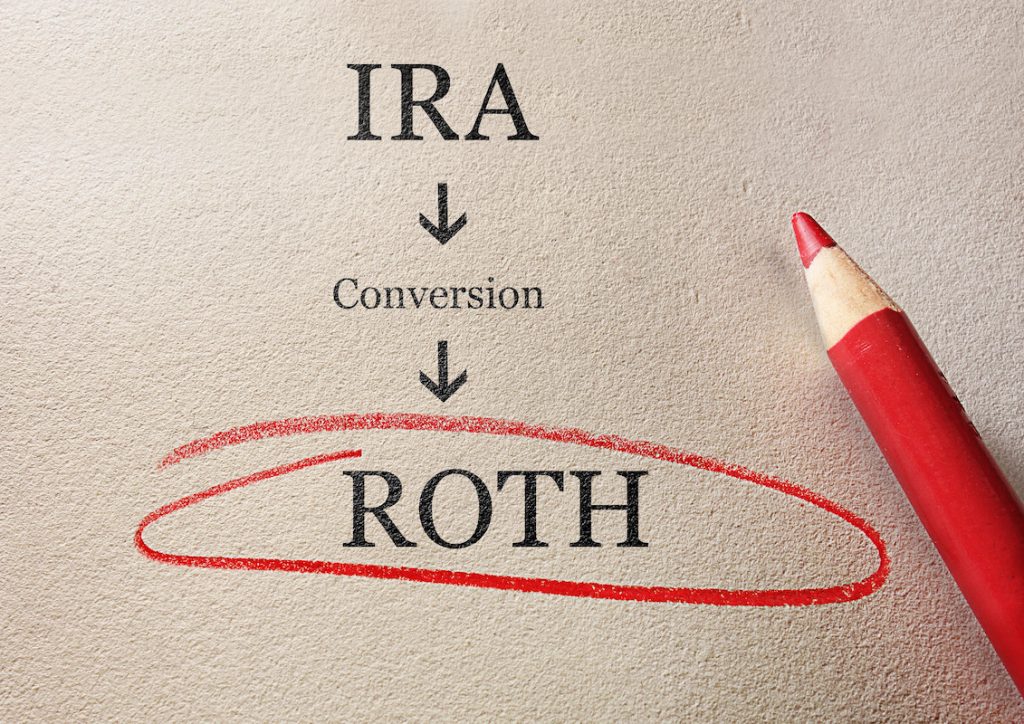

No one wants to pay more taxes, and understanding how to strategize your tax planning to decrease what you pay is certainly not the most...

13 Jan, 2023

Executive compensation plans have only increased in complexity as company strategy and compensation programs have juggled with balancing an executive pay structure that everyone can...

29 Dec, 2022

Wealth management and control of your financial future can be a daunting task, and it is often a task that requires regular maintenance. For executives,...

28 Dec, 2022

There are many types of financial advisors and finding the right one for you and your situation is instrumental in meeting your financial goals. This...

26 Dec, 2022

Managing one’s wealth is something that takes strategic financial planning and discipline. The importance of managing one’s wealth and assets becomes even more important if...

15 Dec, 2022

How do you know if your financial advisor has a conflict of interest? Many people don’t realize that their financial advisor may be recommending products...

22 Nov, 2022

The best wealth management firm in the Washington D.C. area will encourage you to ask as many questions as possible. You should feel a calming...

18 Nov, 2022

If you’re like many high-net-worth individuals, you demand exemplary wealth management service. You want a team of financial advisors that will handle your investments with...

8 Nov, 2022

The value of a wealth management team with realistic expectations means the world to investors trying to survive the constantly evolving financial landscape. As the...

1 Nov, 2022

Affluent investors often work with their wealth management firm to develop a sophisticated legacy (estate) plan. This plan typically addresses how your assets will be...

13 Oct, 2022

It’s not enough to have money in the bank these days. You need a financial ally and accountability partner who can lead your decision-making processes...

29 Sep, 2022

Succession planning is a process of identifying people who will succeed current leaders and is crucial to any business looking to remain competitive in its...

26 Sep, 2022

As a small business owner, having a comprehensive financial plan in place that aligns with your goals is essential. You need to know that all...

12 Sep, 2022

Managing your business’s investment risk is integral to being a successful entrepreneur or business owner. Although it’s impossible to predict the future, you can take...

30 Aug, 2022

A business is a living, breathing organism whose operation and trajectory will vary depending on its stage of growth. And just like with people, it’s...

26 Aug, 2022

Entrepreneurs wear multiple hats. In fact, there can be so many that it is easy to get caught up in the everyday tasks and activities,...

24 Aug, 2022

We understand that running a business isn’t easy. There are multiple challenges that arise daily, and it’s important to stay on top of them all,...

28 Jul, 2022

As a financial advisor in the Washington D.C. area, the quality of our relationships with clients is what sets us apart. It’s not enough to...

25 Jul, 2022

How do you manage market volatility? Managing an investment portfolio can be a challenge in any economy, and market turbulence tests investors further. One critical...

18 Jul, 2022

When it comes to money and financial planning strategies, there’s varied advice out there. While some tips are helpful, others can leave you feeling overwhelmed...

8 Jul, 2022

Can you be successful without a financial plan? Of course! The question is not whether a financial plan is the only way to achieve success,...

6 Jul, 2022

In order to get to where you want to go, you must navigate life with meaningful plans and life goals. This often begins as an...

16 Jun, 2022

Goals are specific and measurable targets that create a roadmap for you to follow and can ultimately help you: Stay focused Remain motivated Achieve more...

31 May, 2022

Market corrections are normal. Even so, not every investor knows how to handle market volatility. It is easy to feel great about your investment choices...

25 May, 2022

Cash is liquid, simple, and feels secure. There are many good reasons to keep some cash on hand, from maintaining an emergency fund to being...

12 May, 2022

Volatility is typically coupled with opportunity. This is a valuable trend to understand if you are in the wealth accumulation phase. However, investors who are...

26 Apr, 2022

There are situations where fear can serve you well. If you are driving in heavy fog and low visibility, fear will tell you to slow...

22 Apr, 2022

Life pulls us in many directions with obligations and opportunities, including many ways to spend our money. Even high-income earners can be challenged to save...

18 Apr, 2022

Although it has caused a media stir, inflation is not all bad or good. It’s dualistic in nature—having positive and negative impacts on different parts...

8 Apr, 2022

Your financial discipline is how well you adhere to your financial plan and monetary goals. This is a critical factor in any individual’s success and...

6 Apr, 2022

Those not well-versed in the financial industry might think wealth creation is as simple as making money, spending less than you earn, and investing some...

4 Apr, 2022

Entrepreneur startup statistics rank Washington D.C. as the top U.S. city for business start-ups, with 71.1% of its population comprised of young professionals ages 25-34....

31 Mar, 2022

For most of us, instant gratification is hard to deny. We have only to look at the economy to know that it’s true. Simple, fast,...

29 Mar, 2022

If you’ve ever walked into a mess hoping to accomplish something—whether it’s the kitchen, your desk at work, or your tax return—you know that disorder...

16 Mar, 2022

Brown | Miller Wealth Management is pleased to announce the launch of our new and improved website. The enhanced design and layout make it easier...